Remember the ritual? A quick stop after work or on the way home from the grocery store. Scrolling through movie covers on a bright touchscreen bathed in the glow of fluorescent lights or the setting sun. Before streaming giants like Netflix and Amazon Prime reshaped home entertainment, movie rental kiosks history were a convenient middle ground between traditional video rental stores and on-demand digital services.

The satisfying whir as the machine dispensed your chosen DVD for a dollar or two a night. For a time, the movie rental kiosk was a ubiquitous part of the landscape, a symbol of convenience and affordable entertainment. Let’s rewind and trace the surprisingly rapid rise and fall of this unique chapter in home media history.

The Genesis Era: Beyond the Video Store (Late 1990s – Early 2000s)

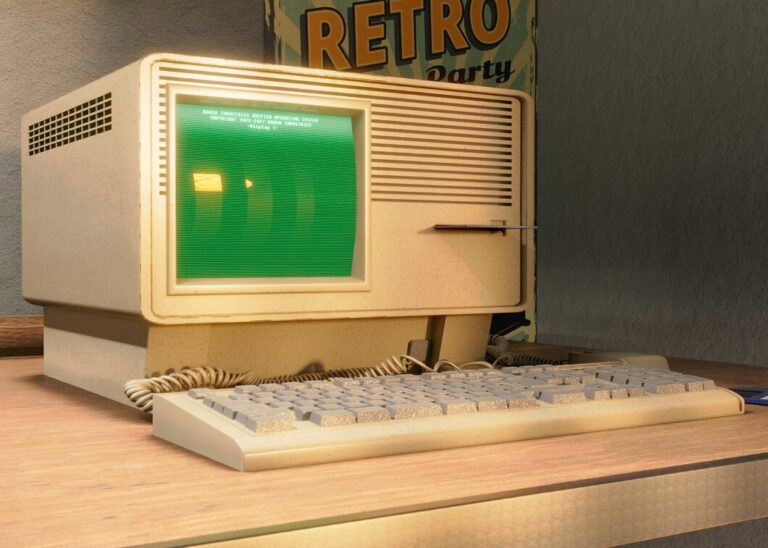

Before bright red boxes dotted street corners, renting a movie meant a trip to the video store. Places like Blockbuster and Hollywood Video reigned supreme, their aisles filled with VHS tapes and, later, DVDs. It was an experience – Browse shelves, hoping the new release wasn’t checked out, maybe grabbing some popcorn, but it also had drawbacks: limited hours, the trek to the store, and those dreaded late fees.

Meanwhile, technology was percolating. Vending machines were selling everything from snacks to stamps. The DVD format, launched in 1997, offered better quality and durability than VHS. Entrepreneurs began experimenting: could you automate movie rentals? Early attempts like DVD Play placed kiosks in various locations, but the concept hadn’t yet hit the mainstream. The stage was being set for a disruption.

Kiosk Model Spotlight: Early Concepts (e.g., DVDPlay)

These pioneering kiosks tested the waters, proving the technical feasibility of automated DVD rental. They often featured touchscreens and credit card readers but lacked the scale, branding, and refined logistics needed for mass adoption. They were the beta test for what was to come.

Parallel Developments

Netflix launched its revolutionary DVDs-by-mail subscription service in 1998, eliminating late fees and offering a vast selection, albeit with a wait time for delivery. Broadband internet was slowly expanding, hinting at future digital possibilities, but physical media was still king. Video stores were at their peak but facing nascent challenges.

User Experience Snapshot

Renting involved Browse physical shelves, interacting with staff, and adhering to store hours. Forgetting to return a tape on time could lead to hefty penalties. The idea of a 24/7 automated rental point was still largely theoretical for most consumers.

The Breakthrough Years: Enter Redbox (2002 – Mid-2000s)

The game truly changed in 2002. Redbox, initially a venture by McDonald’s Corporation, began testing automated kiosks designed to offer convenience and value – starting with various items, but quickly focusing on $1-per-night DVD rentals. Placed initially in McDonald’s locations, the concept tested well.

The bright red kiosks were eye-catching, the touchscreen interface was relatively intuitive (even when smartphone ubiquity was years away), and the price point was incredibly aggressive compared to traditional rentals.

In 2005, Coinstar (known for its coin-counting machines) invested heavily, fueling rapid expansion. Redbox kiosks began appearing everywhere – grocery stores, pharmacies, convenience stores.

Their business model focused on new releases, leveraging high turnover and low overhead. The “return anywhere” policy added immense convenience. By 2007-2008, Redbox had surpassed the declining Blockbuster in US locations and rentals.

Kiosk Model Spotlight: Redbox (Early Generation)

- Concept: Fully automated DVD rental via touchscreen.

- Capacity: Around 600-700 discs, focusing on 70-200 unique new release titles.

- Price: Initially $1/night + tax.

- Convenience: 24/7 access, widespread locations, return to any kiosk.

- Technology: Utilized modems for inventory tracking and transaction processing.

Milestone Markers

- 2002: Redbox concept originates within McDonald’s.

- 2004: First market tests in Denver McDonald’s.

- 2005: Coinstar invests, fueling national expansion.

- 2007-2008: Redbox surpasses Blockbuster in US locations/rentals.

- Late 2000s: Kiosks become ubiquitous in high-traffic retail locations.

Price Point Perspective

At $1/night, Redbox dramatically undercut traditional video store rentals (often $4-$5 for a few nights). This value proposition was a massive driver of adoption, especially during the economic downturn of the late 2000s.

User Experience Snapshot

Using a Redbox kiosk felt futuristic yet simple. A quick swipe of a credit card, a few taps on the screen, and your movie night was sorted in moments, often during a routine grocery run. No membership fees, no clerks, just instant gratification (as long as the movie you wanted was in stock). Do you remember your first Redbox rental?

[CULTURAL CONTEXT SUGGESTION: A photo of a Redbox kiosk outside a busy grocery store entrance, illustrating its integration into daily errands.]

The Refinement Period: Peak Kiosk (Late 2000s – Early 2010s)

This was the zenith of the rental kiosk. Redbox, having acquired full ownership from Coinstar/McDonald’s investors, dominated the physical rental market. Kiosk counts swelled, exceeding 40,000 in the US at their peak (around 2012-2013). They added Blu-ray discs and video game rentals, expanding their offerings.

Competitors emerged, notably NCR’s kiosks often branded as “Blockbuster Express” after Blockbuster’s bankruptcy, attempting to mimic Redbox’s success, but Redbox maintained the lion’s share.

Redbox refined its operations, using online reservations and mobile apps to let users check availability and reserve discs.

They successfully navigated legal battles with movie studios over rental windows for new releases. For several years, Redbox kiosks were the primary way many Americans rented newly released movies physically, accounting for roughly half of all disc rentals in the US at their peak.

Kiosk Model Spotlight: Redbox (Peak Generation)

- Offerings: DVDs, Blu-rays, Video Games.

- Features: Online/app reservations, enhanced touchscreen interface, vast network (~43,700 kiosks at peak).

- Market Share: Over 45-50% of the US physical disc rental market (around 2012-2013).

- Financials: Rented billions of discs, generated nearly $2 billion in annual revenue at its height.

Innovation Timeline (Conceptual)

- Mid-2000s: Rapid expansion, DVD focus.

- Late 2000s: Introduction of Blu-ray.

- ~2011: Addition of video game rentals.

- Early 2010s: Peak kiosk count, mobile app integration for reservations.

What We Gained / What We Lost

- Gained: Unmatched convenience for physical new releases, extremely low prices, 24/7 access. Helped hasten the demise of late fees.

- Lost: The Browse experience and wider catalog of video stores. Kiosks focused narrowly on new hits. Human interaction/recommendations disappeared.

User Experience Snapshot

Renting from a kiosk became second nature. You knew where your closest ones were. You might check the app before heading out. It was efficient, cheap, and reliable for catching recent blockbusters you missed in theaters. It felt like the modern way to rent.

The Revolution: The Streaming Tsunami (Mid-2010s – Early 2020s)

The seeds of the kiosks’ decline were sown even as they peaked. Broadband speeds increased, smart TVs proliferated, and streaming services, led by Netflix (which pivoted aggressively from DVDs-by-mail), exploded in popularity. Why drive to a kiosk for one movie when you could access thousands instantly from your couch for a low monthly fee?

Redbox’s key advantages – price and convenience – were eroded by streaming’s even greater convenience and vast libraries. Kiosk rentals began a steady decline. Redbox tried to adapt, launching its own streaming service (Redbox On Demand/Free Live TV) and even venturing into film production (Redbox Entertainment).

However, competing with tech giants like Netflix, Amazon, Disney, and HBO proved incredibly difficult. Parent company Outerwall was taken private by Apollo Global Management in 2016, and Redbox was later spun off. The company went public via SPAC in 2021 but faced mounting financial pressure.

Kiosk Model Spotlight: The Decline Phase

- Challenges: Plummeting rental numbers, difficulty competing in streaming, studio window disputes impacting new release availability.

- Strategic Moves: Launching digital streaming services, loyalty programs, attempting original content.

- Result: Continued financial losses, declining relevance of the core kiosk business.

Parallel Developments

Streaming becomes the dominant mode of home entertainment. Major studios launch their own direct-to-consumer platforms (Disney+, HBO Max, Peacock). Interest in physical media wanes significantly for the average consumer.

Industry Voice

Analysts increasingly questioned the long-term viability of the kiosk model in the face of overwhelming streaming adoption. Redbox executives publicly maintained optimism but faced undeniable market shifts.

User Experience Snapshot

You probably noticed yourself using kiosks less frequently. Maybe you still grabbed a cheap rental occasionally, but streaming subscriptions became the default for movie nights. The kiosks started feeling a bit like relics of a slightly earlier time.

The Modern Landscape: The Aftermath (2024 – Present)

The final chapter unfolded rapidly. In 2022, Chicken Soup for the Soul Entertainment (CSSE), operator of Crackle, acquired Redbox, hoping to leverage its customer base and brand for its streaming ambitions. The deal saddled CSSE with Redbox’s significant debt. The financial situation deteriorated quickly. Reports emerged of unpaid bills to retailers hosting the kiosks and content providers.

By June 2024, CSSE filed for bankruptcy protection, initially Chapter 11, quickly converted to Chapter 7 liquidation in July 2024. Redbox’s online services and app ceased functioning. The kiosks, numbering around 24,000-28,000 by late 2023/early 2024 but often unstocked or malfunctioning due to the cash crunch, were effectively abandoned.

Retailers like Walgreens and CVS were left with thousands of powered, non-functional machines, facing removal costs and potential security risks from stored data. Reports surfaced of people raiding the defunct kiosks for free discs or even hobbyists acquiring the machines to tinker with.

Easter Egg Spotlight: The Kiosk Raids (Late 2024)

- The “Egg”: Following the bankruptcy, some discovered that kiosks still connected to power might dispense discs without charging, leading to widespread plundering shared on forums like Reddit.

- Significance: A bizarre, slightly chaotic end-note highlighting the abrupt collapse of the operational infrastructure and the lingering presence of the physical machines.

Unexpected Consequences

The bankruptcy left retailers with the costly burden of removing heavy, often anchored and hard-wired machines. It also created a niche community dedicated to hacking or repurposing the abandoned hardware, a final, strange twist in the kiosk lifecycle.

User Experience Snapshot

As of April 2025, encountering a functional Redbox kiosk is highly unlikely. They represent a closed chapter, rapidly disappearing from the retail landscape. For most, movie rental is now entirely digital.

Full Circle Reflections

The movie rental kiosk was a brilliant transitional technology. It perfectly bridged the gap between the cumbersome video store era and the fully digital streaming age. Redbox, in particular, leveraged logistics, value pricing, and convenience to dominate physical rentals for a crucial period. It democratized access to new releases at an affordable price point.

However, its reliance on physical media and a specific type of convenience ultimately couldn’t compete with the overwhelming ease and selection offered by streaming. The kiosks rose meteorically by disrupting the old model (video stores) but were just as quickly disrupted by the next wave (streaming).

The Legacy Continues

The rental kiosk’s legacy is one of disruption and transition. It demonstrated the power of automated retail and convenience but also served as a stark reminder of how quickly consumer habits can shift in the face of superior technology. Those bright red boxes, now fading from view, stand as monuments to the last hurrah of mainstream physical movie rentals.

FAQ: Kiosk Queries

- What were movie rental kiosks?

They were automated vending machines, most famously operated by Redbox, allowing customers to rent DVDs, Blu-rays, and sometimes video games 24/7 using a touchscreen and credit card. - Who made rental kiosks popular?

Redbox, founded in 2002 and rapidly expanded after 2005, made rental kiosks ubiquitous across the United States, known for their $1/night pricing and convenient locations. - Why did movie rental kiosks decline?

The primary reason was the explosive growth and convenience of streaming services (Netflix, Hulu, etc.), which offered instant access to vast libraries without needing to leave home. Declining interest in physical media also played a key role. - What happened to Redbox? Are the kiosks still around?

Redbox’s parent company filed for bankruptcy and ceased operations in mid-2024. While some physical kiosks might still be standing temporarily, they are non-functional and are being removed by retailers or scavenged. The service is defunct. - How much did kiosk rentals cost?

Redbox famously launched at $1 per night per DVD. Prices eventually increased slightly, with Blu-rays and games costing more (e.g., $2.25-$2.50 per night in later years), but they remained significantly cheaper than traditional video store rentals or digital purchases/rentals of new releases.